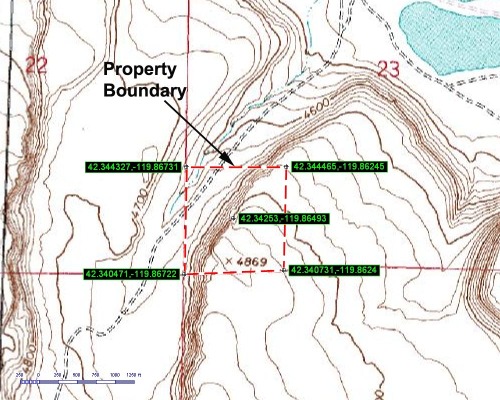

With the widespread availability of GPS (Global Positioning System) devices, an increasing number of our clients have inquired about the GPS waypoints — or center points and/or corners — of the approximate location of property. One of the services that we provide to our customers is the geographic coordinates of a property. This technology makes it easy for nearly anyone to access property. It is standard practice in the industry and is considered part of our customer service program here at Mission.

GPS devices use a system of satellites to accurately locate positions on the surface of the earth. The accuracy of any particular location varies and depends on many criterion: the model of GPS unit (usually directly related to cost); type of coordinate system employed; natural obstructions (trees, cliffs, mountains, etc.); geodetic datum used; electromagnetic interference; and a small level of scrambling by the government. Most commercial GPS units can accurately locate a specific point on the earth’s surface within at least 40 or 50 feet.

GPS units use a variety of geographic coordinate systems to locate positions on the globe. Geographic coordinate systems are devised to map a 3-dimensional position on the globe to a 2-dimensional document. The most commonly known geographic coordinate system is longitude and latitude, although there are several other alternative systems (UTM, Decimal Degrees, State Plains Coordinates, and others).

Geographic coordinate systems tie into datums. Datums are used to translate satellite data to positions indicated on a real map. Simply put, these are utilized because the earth is not a perfect sphere. Turns out the world is not a globe after all…

Directions to a specific property are generally compiled using available maps and online resources. The use of GPS by our customers allows them to confidently find the location of a property. This is especially true for larger-acreage property. For example, if you can locate the center point for a 40-acre parcel of land, it is very likely that you are within the boundaries of that property. However, the margin of error would be much smaller on a .06 acre property.

While GPS is a very useful tool, it is important to remember that GPS data is not survey-grade. In other words, don’t sink survey stakes, put up a fence, or construct a road based on GPS data, as you may be on your neighbor’s land. There is survey-grade GPS equipment out there, but it is always used in conjunction with an on-the-ground survey. Most county and local government authorities do not accept GPS data for legal boundaries of a property.

If you would like to find the location of a property using a GPS device, it is relatively simple. We keep our data in the decimal degrees geographic coordinate system using the WGS84 datum (the most commonly used datum in the United States). If you are familiar with your GPS device, it is relatively easy to change the coordinate format (usually in settings) to decimal degrees and set the datum to WGS84 (most likely the default). It is important that you are using the correct datum or your location can be thrown off substantially.

If you are relatively new to GPS, do not despair. Just look at the format of a standard waypoint in your unit and convert the decimal degrees to that format. We promise there is no math. There are a number of free websites that can easily convert coordinates to the format of your choice. The following are some of our personal favorites:

Latitude, Longitude, Coordinate and Conversion

Latitude/Longitude Conversions

Jeep Reviews GPS Coordinate Conversion

If you are still stuck, there are literally thousands of places on the internet about GPS, or just ask us and we can try and walk you through it. Have fun exploring!